9497502024 , 8635004028 , 4805733945 , 2254686013 , 9102163074 , 9736854499 , 7636143033 , 9046974877 , 7158988038 , 9362460049 , 6097398735 , 5052530596: How to Build a Winning Investment Portfolio

Building a winning investment portfolio necessitates a methodical evaluation of financial goals and risk tolerance. Investors must recognize the importance of asset allocation and diversification in mitigating potential losses. Regular performance assessments and strategic rebalancing are crucial to maintain alignment with evolving objectives. Understanding these foundational principles can significantly influence investment outcomes. However, many investors overlook critical steps that could enhance their portfolio's resilience and growth potential.

Assessing Your Financial Goals and Risk Tolerance

How can investors effectively align their financial aspirations with their capacity for risk? A thorough risk assessment is essential in evaluating financial objectives.

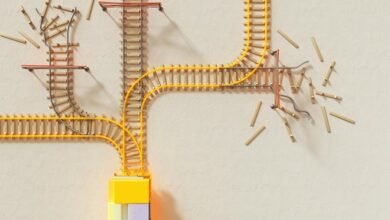

Diversification: The Key to a Balanced Portfolio

Investors seeking to achieve their financial goals must also consider the importance of diversification in their portfolios.

Effective asset allocation across various asset classes mitigates risks associated with market volatility. By spreading investments among stocks, bonds, and alternative assets, investors can reduce potential losses while enhancing overall returns.

This strategic approach fosters a balanced portfolio, empowering investors to navigate changing economic landscapes with confidence.

Regular Monitoring and Rebalancing Strategies

Regular monitoring and rebalancing of an investment portfolio are essential practices that ensure alignment with an investor's financial objectives and risk tolerance.

This involves continuous performance evaluation and analysis of market trends to identify necessary adjustments.

Conclusion

In conclusion, constructing a successful investment portfolio necessitates a meticulous evaluation of personal financial aspirations, risk tolerance, and asset diversification. By implementing regular monitoring and rebalancing strategies, investors can adapt to changing market dynamics and maintain alignment with their goals. Ultimately, isn't it prudent to consider how a well-crafted portfolio can safeguard your financial future while promoting growth? Embracing these principles not only enhances resilience but also positions investors for long-term success in an unpredictable market environment.