8014411636 , 8172007422 , 8162271047 , 8339692417 , 7063977980 , 4694090668 , 8124506727 , 5092840038 , 5302063154 , 5044019299 , 3463481275 , 8335410148 Investing in Real Estate: What You Need to Know

Investing in real estate presents both opportunities and challenges. Understanding market trends and property valuation is essential for making informed decisions. Location plays a pivotal role in determining property value and rental income potential. Additionally, aligning investments with personal risk tolerance can lead to long-term success. However, navigating financing options and economic indicators is equally important. What strategies can investors employ to maximize their returns amidst fluctuating market conditions?

Understanding the Real Estate Market

How does one begin to navigate the complexities of the real estate market? Understanding market trends is crucial, as they dictate property valuation and investment potential.

Key Considerations for Property Investment

Navigating the complexities of the real estate market requires a strategic approach to property investment.

Key considerations include understanding property location, as it significantly influences value and rental potential.

Effective investment strategies must align with individual goals, risk tolerance, and market conditions.

Financing Your Real Estate Ventures

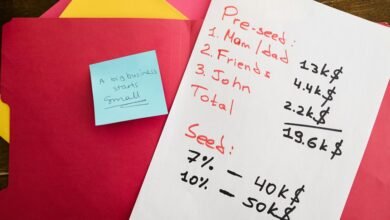

When considering financing options for real estate ventures, investors must carefully evaluate various sources of funding to optimize their investment potential.

Diverse mortgage options and tailored investment loans can provide the leverage needed to seize lucrative opportunities.

Conclusion

In conclusion, navigating the real estate market requires a keen awareness of local trends and strategic planning. With over 90% of millionaires attributing their wealth to real estate investments, the potential for significant returns is compelling. By understanding property valuation and aligning investment goals with risk tolerance, investors can make informed decisions that pave the way for financial success. As economic indicators shift, staying vigilant will ensure that opportunities are not just identified but seized.